canadian tax strategies for high income earners

Tax Saving Strategies for High-Income Earners. To become one of the top 5 of Canadian households in 2022 your.

Tax Planning Strategies For High Income Canadians

5 Tax Strategies For High Income Earners Pillarwm Scraping By On 500k A Year Why It S So Hard To Escape The Race How Pro Athletes And Other High Earners Stick Handle.

. This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income. Tax-free savings accounts TFSAs are another option.

Income splitting and trusts. This is one of. The average Canadian household income will be 51990 in 2022 according to the Census Bureau of Canada.

The average Canadian has access to 2-3 tax-sheltered accounts and can shelter 30 of their gross income. The Canadian tax system specifies tax rates for the various income levels and. 8 Ways The TFSA Could Change.

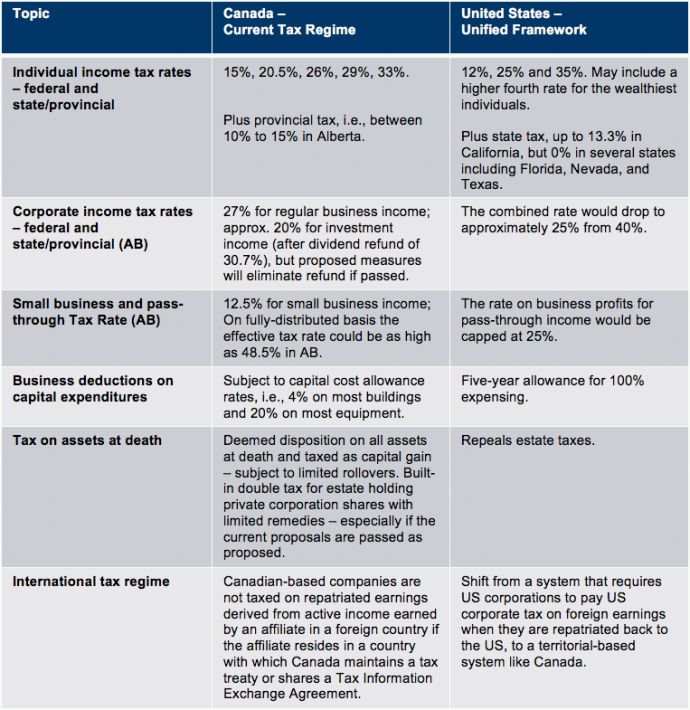

Income splitting and trusts. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Split your income or pension with your spouse.

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your. This is one of the most important tax strategies for you as a high-income earner. Use Roth Conversions Wisely and Regularly.

For 2022 the maximum employee deferral to 401 k is 20500. While the money you contribute to your TFSA will be post-tax income any interest dividends or capital gains earned. If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions meaning you can.

Tax Strategies For Families With Children. Family Income Splitting and Family Trusts. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Just as contributing to RRSPs lowers your taxable income so too may income splitting. TurboTax Has A Variety Of Solutions And Tools To. If properly structured family trusts or partnerships can help you move your.

It means another opportunity to save tax Chen says. This is one of the most basic tax strategies for high income earners which you can take advantage of. That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you.

Tax Tips For Earners In 2020 Loans Canada from loanscanadaca. This article highlights a non-exhaustive list of tax. Tax Saving Strategies For High Income Earners Canada.

Tax minimization strategies for individuals Income splitting with family.

How Pro Athletes And Other High Earners Stick Handle High Canadian Income Taxes The Globe And Mail

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

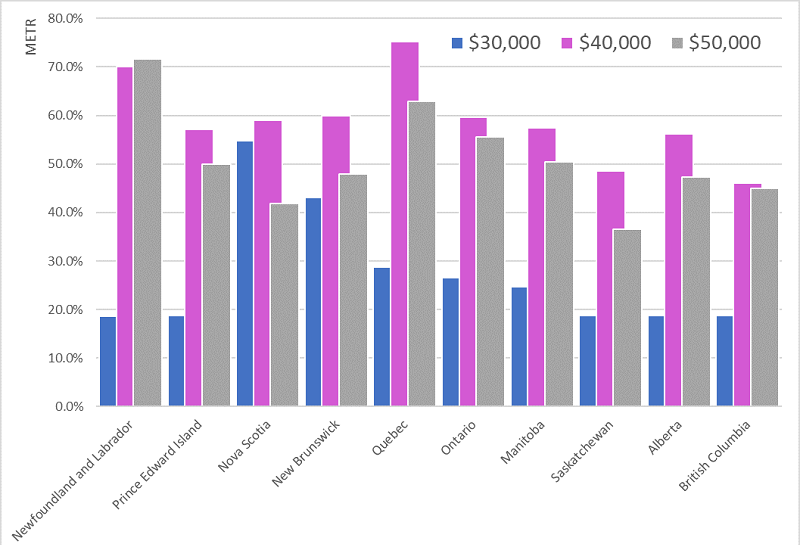

The Grass Is Getting Greener On The Other Side Of The Border Taking Your Business Southward Is A No Brainer Tax Authorities Canada

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Taxes For Canadians For Dummies Henderson Christie 9781894413398 Amazon Com Books

How To Reduce Taxes For High Income Earners In Canada Qopia Financial

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

High Income Earners Need Specialized Advice Investment Executive

Measuring Progressivity In Canada S Tax System Fraser Institute

Everyday Tax Strategies For Canadians Td Wealth

Low Income Families In Canada Hit Hard By High Effective Tax Rates Fraser Institute

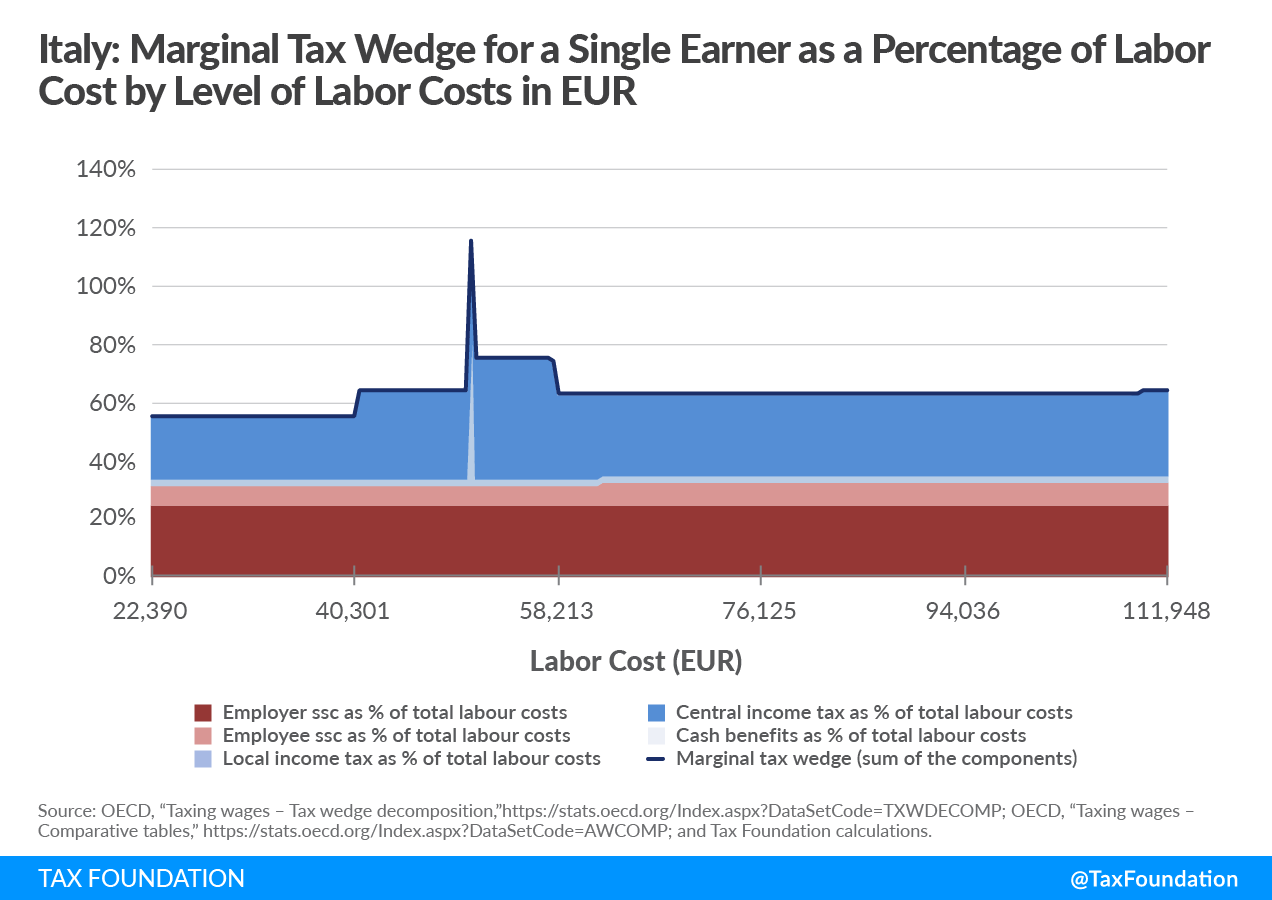

Italy Income Tax System Navigating Complex Income Taxes In Italy

Provincial Taxation Of High Incomes

10 Tax Planning Strategies For High Income Earners Gamburgcpa

How The Wealthy Reduce The Tax Man S Take The Globe And Mail